Employer Info

Helpful Information for Employers

Have you noticed, planning a benefit package for your employees has gotten a lot more complicated. High Deductible Health Plans (HDHP), Health Flexible Saving Accounts (HFSA), Health Reimbursement Arrangements (HRA) and Health Savings Accounts (HSA). What combination of this “alphabet soup” will meet your goals and the needs of your employees? What are the IRS rules? How do we go about setting up these plans? Compensation Consultants, Ltd. can help you in the design, implementation and administration of your employee benefit plans.

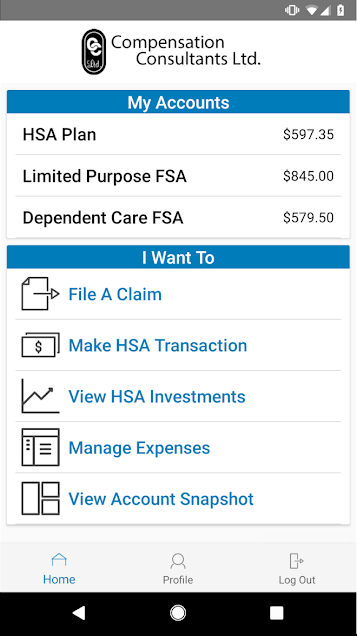

Compensation Consultants, Ltd. is a non-insurance affiliated contract administration service provider with over 20 years of experience in the employee benefits arena. We work as an integral part of your benefits team to deliver the best possible benefits program that will satisfy your company and your employees needs. The following is a very brief explanation of the more common benefit plans.

A Cafeteria Plan is a written plan in which participating employees can select qualifying benefits from a “menu” of choices. It allows eligible employees to pay for un-reimbursed medical expenses, dependent day care expenses and certain employer-sponsored insurance plans with pre-tax dollars. This saves the employee Federal, State and FICA taxes. It is like getting a pay raise via Uncle Sam. You, as the employer/plan sponsor, save FICA and FUTA payroll taxes as well. In most instances, this tax saving pays for the cost of plan implementation and administration services.

The HRA is an Employer only contribution plan and is receiving quite a bit of attention these days. The “Bridge “plan design is being utilized quite heavily by Employers who are in need of controlling escalating premium costs. The HRA is coupled with a high-deductible (HDHP) that substantially reduces the premium. The premium savings is allocated to the HRA, per employee, to pay for higher deductible expenses after a specified out-of-pocket deductible has been met. This approach is designed to make employees better consumers of health care. The HRA plans are usually dovetailed with a Cafeteria plan to allow employees the opportunity to contribute extra funds for medical and childcare expenses on a before-tax basis.

An HSA is a tax-exempt trust or custodial account established exclusively for the purpose of paying qualified medical expenses of the account beneficiary who, for the months for which contributions are made to an HSA, is covered under a high-deductible health plan. This plan is relatively new and some like to over simplify the IRS rules governing the plan. We can help you to establish a plan that meets all the IRS compliance issues associated with an HSA.